The financial services sector is undergoing a profound shift driven by digital transformation. Organisations within this industry, ranging from banking and investment firms to insurance and wealth management companies, are increasingly recognising the imperative to innovate digitally or risk falling behind competitors. This article explores the urgency and benefits of digital transformation in financial services, highlighting key themes and the role of technology in achieving competitive advantage.

Embracing Digital Transformation

Digital transformation in financial services encompasses the integration of digital technologies into all areas of operations, fundamentally changing how organisations operate and deliver value to customers. This transformation is not merely about adopting new technologies but entails a strategic overhaul of business processes, systems, and customer interactions. For instance, private equity firms are leveraging ERP and EPM solutions to streamline operations and enhance decision-making capabilities. In financial services, this transformation is driven by the need to improve efficiency, enhance customer experiences, and gain a competitive edge. Companies like Systematica Investments, Oakley Capital Investments, and Partners Capital LLP, prominent players in private equity, have harnessed digital tools to enhance their investment strategies and operational efficiencies. By adopting advanced data analytics and business intelligence (BI) solutions, these firms can make more informed investment decisions and better manage their portfolios.

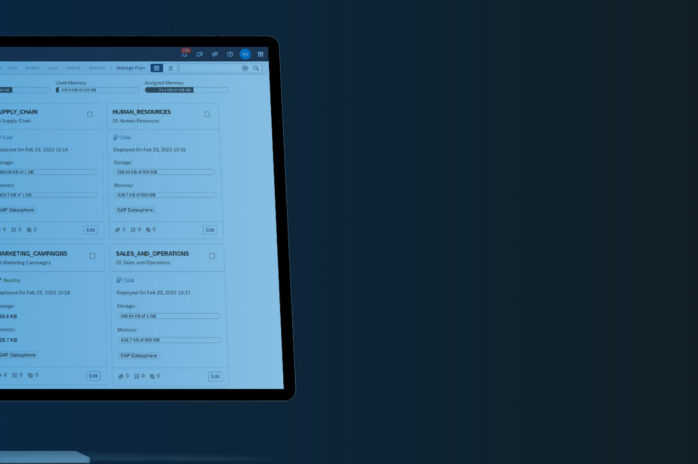

Leveraging ERP and EPM for Operational Excellence

Enterprise Resource Planning (ERP) and Enterprise Performance Management (EPM) systems are vital components of digital transformation in financial services. These systems streamline processes, enhance data visibility, and improve decision-making capabilities. Financial institutions rely on ERP and EPM solutions to manage their complex operations and ensure regulatory compliance.

ERP systems integrate various business functions—finance, HR, procurement, and more—into a single cohesive platform, allowing for seamless information flow and operational efficiency. EPM, on the other hand, focuses on aligning business strategies with performance metrics, enabling organisations to plan, monitor, and analyse their performance in real time. For example, payroll providers can use these technologies to deliver accurate and timely payroll services to their clients, ensuring compliance and operational excellence.

Harnessing the Power of Data and Insights

In the financial services industry, data is a valuable asset. The ability to collect, analyse, and act on data-driven insights is crucial for maintaining a competitive advantage. Business intelligence tools play a significant role in transforming raw data into actionable insights, helping payroll solution firms like Immedis Ltd and iiPay optimise their operations and enhance customer experiences.

By leveraging BI solutions, financial institutions can gain a deeper understanding of market trends, customer behaviours, and operational performance. This enables them to make more informed decisions, identify new business opportunities, and improve overall efficiency. For instance, finance companies like Jaja Finance Ltd can use BI tools to analyse transaction data and provide personalised financial solutions to its customers, enhancing user engagement and satisfaction.

Embracing Cloud IT and AI for Future Readiness

The adoption of Cloud IT and Artificial Intelligence (AI) is accelerating digital transformation in the financial services sector. Cloud-based solutions offer scalability, flexibility, and cost-efficiency, allowing organisations to quickly adapt to changing market demands and technological advancements. Insurance companies like AIG or wealth management organisations such as Utmost Wealth Management are leveraging cloud IT to streamline their operations and improve service delivery.

AI, on the other hand, is revolutionising the way financial institutions operate. From automating routine tasks to providing advanced analytics and predictive insights, AI is enhancing efficiency and driving innovation. For example, invoice finance providers such as Close Brothers Invoice Finance can use AI to automate invoice processing and fraud detection, significantly reducing operational costs and improving accuracy.

Strategic Partnerships and Managed Services

In the quest for digital transformation, partnering with technology experts and managed service providers can be a game-changer. Codestone’s expertise in delivering comprehensive IT solutions and managed services has helped organisations like The Ardonagh Group, Temporis Investment Management, and Auxmoney navigate their digital transformation journeys successfully.

By leveraging Codestone’s capabilities, financial institutions can focus on their core business while benefiting from advanced technology solutions and expert advisory services. This strategic approach enables them to enhance their operational efficiency, improve customer experiences, and stay ahead of the competition.

Payment processing companies such as JCB International (Europe) Limited benefit from Codestone’s managed services, which ensure seamless IT operations, proactive cybersecurity measures, and scalable cloud solutions. This enables these organisations to focus on core business functions while leveraging cutting-edge technology to maintain a competitive edge.

The Path Forward for Financial Services

In today’s fast-paced financial services industry, digital transformation is not merely an option but a critical driver for success. The ability to adapt and innovate using cutting-edge technologies like ERP systems, business intelligence tools, and AI can significantly enhance operational efficiencies and create a lasting competitive advantage. At Codestone, we are digital transformation specialists with nearly three decades of experience in guiding organisations through their digital journeys.

Our approach is tailored to create competitive advantages through enhanced efficiency, superior customer experiences, and a more productive, satisfied workforce. We understand the unique challenges of the financial services sector and provide solutions that help financial institutions.

Whether you are looking to optimise your operations, leverage data for actionable insights, or innovate with AI and cloud technologies, Codestone is here to support your journey. We are committed to helping you navigate the complexities of digital transformation and achieve sustained growth and success.