The financial services industry is characterised by a dynamic landscape where compliance, security, and technological advancements are crucial. As firms navigate these complexities, the importance of a reliable IT infrastructure cannot be overstated. That’s where IT Managed Services Providers (MSPs) come in as the game-changers that offer a range of benefits to enhance operations, security, and efficiency in the financial sector. Here’s a detailed look at how MSPs can revolutionise your financial services business.

The Evolving Demands of Financial Services

Financial institutions face many challenges: regulatory compliance, cybersecurity threats, and real-time data processing needs. Traditional IT methods often fall short. As financial services evolve, institutions need more than reactive IT solutions-they need proactive, scalable, and efficient tech management strategies.

What Are IT Managed Services?

Imagine outsourcing the entire management and support of your IT infrastructure to a team of specialists who live and breathe technology. That’s the essence of IT-managed services. This approach encompasses a broad spectrum of functions—network management, cybersecurity, cloud solutions, and data backup, to name a few. By partnering with MSPs, financial institutions can offload their technology concerns and focus on what they do best.

The Benefits of IT Managed Services

Here’s how MSPs are making a significant impact on the financial sector:

- Boosting Operational Efficiency

Managing IT infrastructure can be overwhelming. The demands of maintaining servers and networks, and ensuring security and compliance are substantial. Managed services offer relief by taking these responsibilities off the table. MSPs provide thorough IT support, including proactive monitoring and quick issue resolution, which minimises downtime and boosts operational efficiency. This leads to smoother operations and allows financial institutions to concentrate on their primary functions.

- Strengthened Security and Compliance

The financial industry’s landscape is riddled with stringent security and compliance requirements. Protecting sensitive data from increasingly sophisticated cyber threats is an ongoing battle. Managed services provide cutting-edge security measures, such as advanced threat detection, robust firewalls, and encryption protocols. MSPs ensure adherence to critical regulations like GDPR, PCI-DSS, and SOX. It’s not just about preventing breaches; it’s about ensuring continuous compliance and shielding against threats.

- Cost Efficiency and Predictable Budgeting

Traditional IT management involves significant capital expenditures on hardware, software, and staffing, with unforeseen IT issues leading to unexpected costs. Managed IT services offer a more predictable and cost-effective approach. Financial institutions typically pay a fixed monthly fee, covering all IT needs, eliminating large upfront investments and providing predictable budgeting. The scalability of managed services allows institutions to adjust IT resources according to their needs, avoiding over-provisioning and reducing costs.

- Access to Expertise and Innovation

Technology evolves at breakneck speed, and keeping up can be a challenge. MSPs are at the forefront of tech trends, bringing invaluable expertise. Partnering with an MSP means tapping into a team of IT professionals skilled in the latest technologies—cloud computing, artificial intelligence, and data analytics. This expertise facilitates the implementation of innovative solutions that drive operational excellence and competitive edge.

- Focusing on Core Business Functions

Outsourcing IT management enables financial institutions to concentrate on their core activities. With IT responsibilities handled by experts, firms can allocate more resources to strategic initiatives—such as developing new products, enhancing customer relationships, or expanding into new markets. This focus can drive growth and strengthen market position.

- Scalability and Flexibility

The financial services sector is a high-stakes environment where adaptability is crucial. MSPs offer the flexibility to scale IT resources up or down as needed. Whether it’s ramping up infrastructure to handle increased transaction volumes or integrating new technologies, MSPs provide the support required to stay agile and responsive.

- Improved Disaster Recovery and Business Continuity

Disasters and IT failures are inevitable, but their impact can be mitigated with a solid recovery plan. MSPs come equipped with comprehensive disaster recovery solutions, ensuring swift restoration of operations and protection of critical data. This capability is indispensable for maintaining client trust and operational stability, especially when data integrity is paramount.

- Enhanced Customer Experience

Customer expectations are at an all-time high, and delivering exceptional service is a key differentiator. MSPs play a vital role in enhancing the customer experience by ensuring IT systems are reliable, fast, and secure. With robust infrastructure backing online banking, mobile apps, and personalised services, financial institutions can offer seamless, satisfying experiences that foster loyalty and satisfaction.

Strategic Considerations for Financial Institutions

When selecting an IT-managed services provider, financial institutions should consider several factors:

- Industry Expertise: Ensure the provider has a proven track record in the financial services sector and understands the unique challenges and regulatory requirements.

- Service Level Agreements (SLAs): Review SLAs to confirm they meet your operational needs and performance expectations.

- Security Protocols: Verify adherence to top-notch cybersecurity practices and data protection standards.

- Scalability: Select a provider capable of growing with your institution and adapting to evolving requirements.

Utilising MSPs: A Strategic Move for Financial Services Firms

The impact of IT Managed Services Providers on the financial services industry is profound. From cost efficiency and strategic advantage to enhanced security and operational excellence, the benefits are undeniable. Outsourcing IT services empowers financial institutions to concentrate on core business functions, leverage cutting-edge technology, and stay competitive.

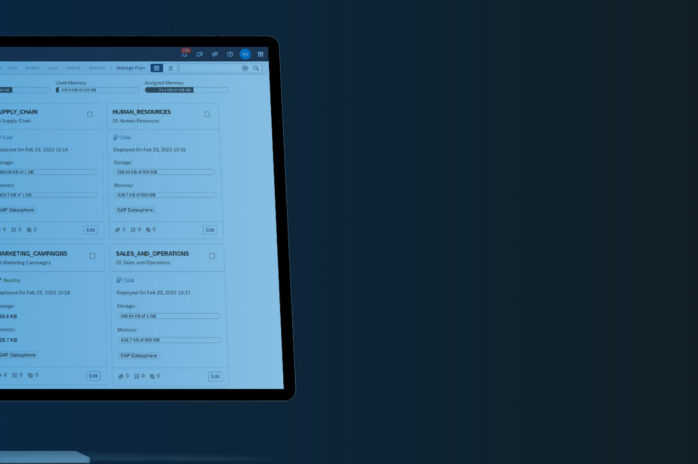

For a trusted MSP partner, consider Codestone’s CloudCare Managed Service. It ensures effective IT management, allowing you to focus on your core business while reaping the rewards of optimal IT operations. Explore Codestone’s CloudCare Managed Service to strengthen your IT foundation and drive business success.